Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final GST taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018 before 29122018. To the notice as well as acuteness of this submission gst 03 return for final taxable period section can be taken as well as picked to act.

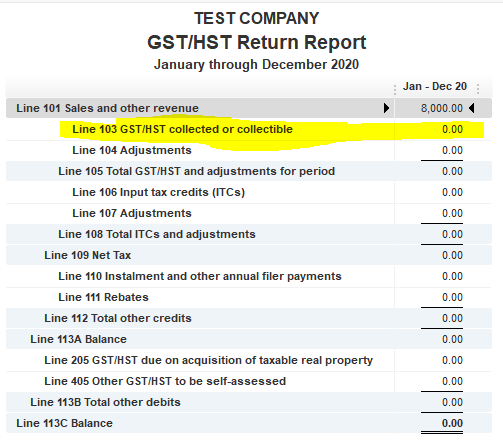

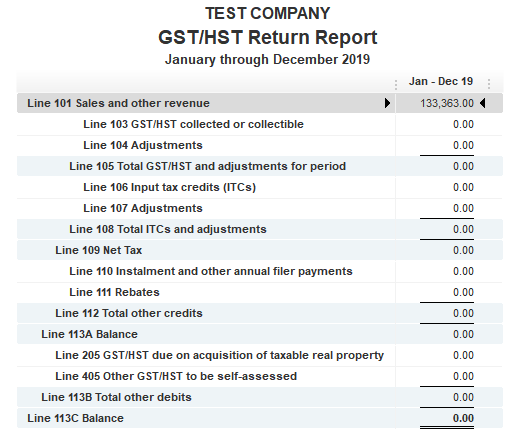

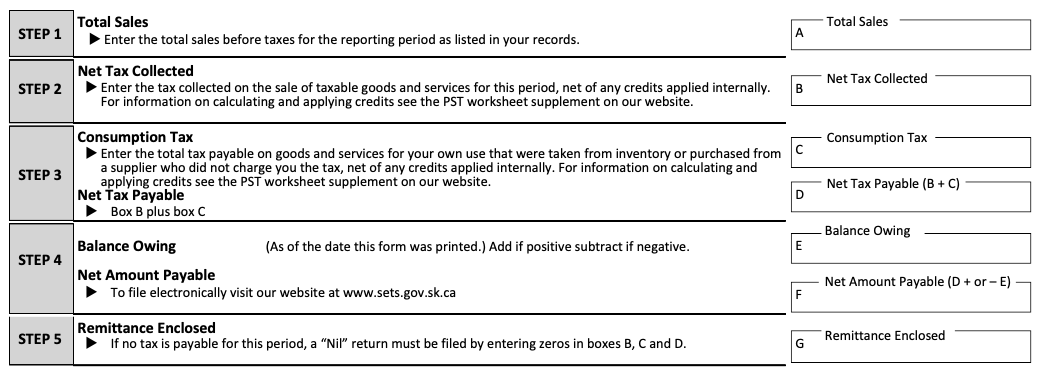

How To Complete A Canadian Gst Return With Pictures Wikihow

- TDS return for Q4 can now be filed till 30th June21 instead of 31st May21.

. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period not later than 120 days from 01092018. Kindle File Format Submission Gst 03 Return For Final Taxable Period Section Thank you very much for downloading submission gst 03 return for final taxable period section. 20 May 2021 The Income Tax Department extends the following due dates - Income Tax Return filing date extended to 31st Dec21 from 30th Sep 2021.

The GST return for the last taxable period. GST03 Final Submission Automation to capture transaction up to 29122018 with GST date For GST Period of 01072018 to 31072018 or until 31072018 then the Return and Payment Due Date will. There is no extension of payment and submission of GST - 03 returns for GST Registered Business whose taxable period is monthly.

This means that a taxpayers last taxable period for GST purposes is the taxable period ending on 31 August 2018. - Form-16 issue date extended to 31st July 2021 from 15th June 2021. As you may know people have search hundreds times for their chosen readings like this submission gst 03 return for final taxable period section but end up in harmful downloads.

Submission GST-03 Return for Final Taxable Period. KMS Business Solutions Sdn Bhd. Please refer to the.

Gst implementation accounting and submission of gst 03 return is handy in our digital library an online entrance to it is set as public appropriately you can download it instantly. Failure to submit by such date would result in an assessment to be undertaken by the Customs Department under Section 43 of the GST Act 2014. GST Submission Guide GST-03 RETURN FOR FINAL TAXABLE PERIOD All GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018 to 29122018.

Any adjustment to be done to the GST-03 Return must be conducted prior to 31 December 2018. Account for GST on taxable supplies made and received ie output tax and input tax respectively Submit GST return GST-03 and pay tax not later than last day of following month after taxable period Issue. Do avoid last minute submission.

Submission GST-03 Return for Final Taxable Period. Taxmanns GST Audit Annual Return Explanation is in complete sync with the current features available at GST Common Portal 8th Edition 2021 FY 2019-20 - Aditya Singhania - 2021-01-02. Pursuant to Section 6 GST Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period which is 31 August 2018 and make full payment for the amount of GST payable.

Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. Please refer to the following schedule for better understandings- Final Taxable Period Monthly Period 01082018 - 31082018 Bi-Monthly Basis 01072018 - 31082018 01082018 - 30092018 Need to account transactions from 01082018 31082018 ONLY. ZenFlex Malaysia GST GAF Viewer.

You may click link address as below for your reference. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. Press alt to open this menu.

Az Lee Management Sdn Bhd. Submission of GST-03 Return for Final Taxable Period within 120 days from 192018 ie. Previous Next LAST SUBMISSION AND PAYMENT DATE FOR GST 03 Please be informed that all GST registrants are required to submit the GST-03 Return and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from September 1st 2018.

Submission of GST 03 GST 04 for final taxable period. Our digital library saves in compound countries allowing you to get the most less latency period to download any of our books past this one. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018.

1 The final acceptance of claim of reduction in output tax liability in respect of any tax period specified in sub-section 2 of section 43 shall be made available electronically to the person making such claim in FORM GST MIS 3 through the Common Portal. On or before 29122018. Sections of this page.

Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. Registered you are responsible for.

How To Complete A Canadian Gst Return With Pictures Wikihow

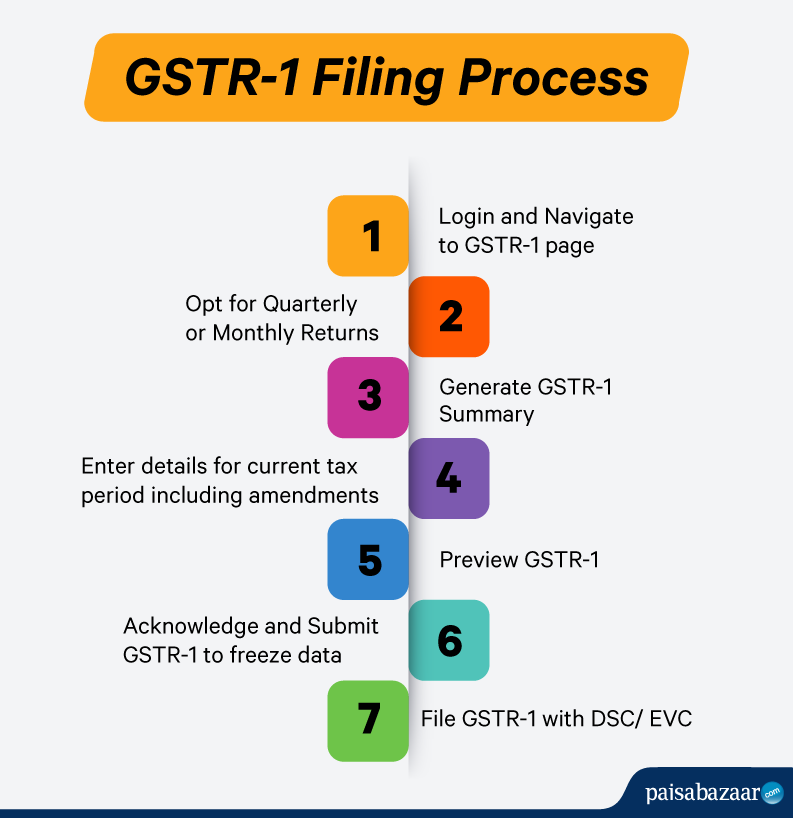

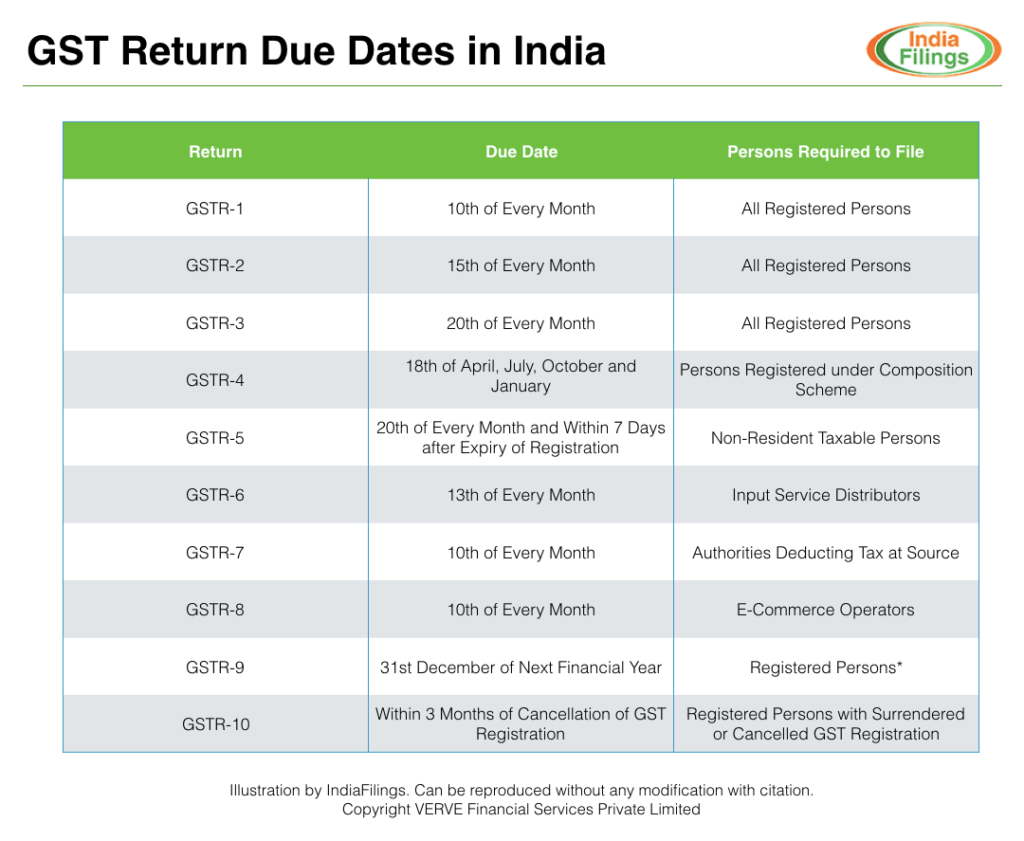

Gst Return Forms Types Due Dates And Late Filing Penalties

How To Complete A Canadian Gst Return With Pictures Wikihow

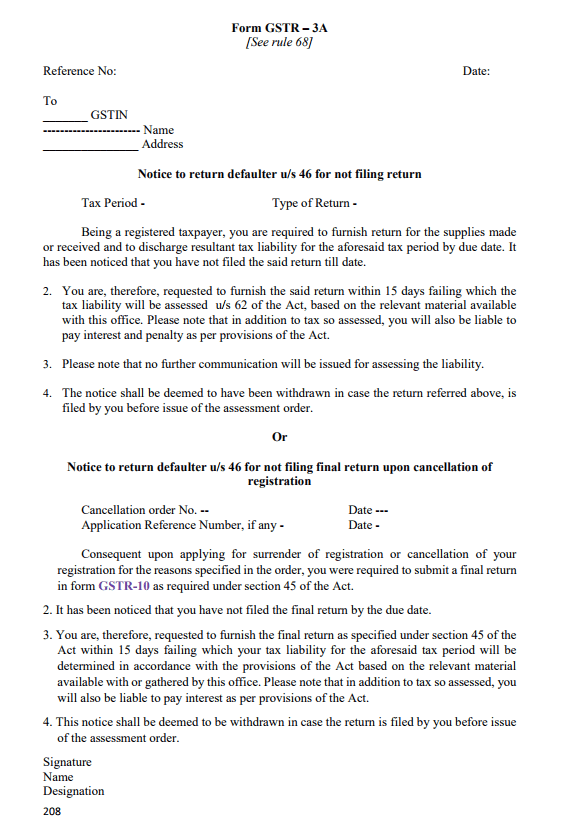

Gstr 3a Notice For Not Filing Gst Return Indiafilings

Due Dates Of Gst Payment With Penalty Charges On Late Payment

Updates In Gst Return Due Dates Gstr 1 Gstr 3b Filling Dates

Canada Gst Pst Hst Complete Guide For Canadian Businesses

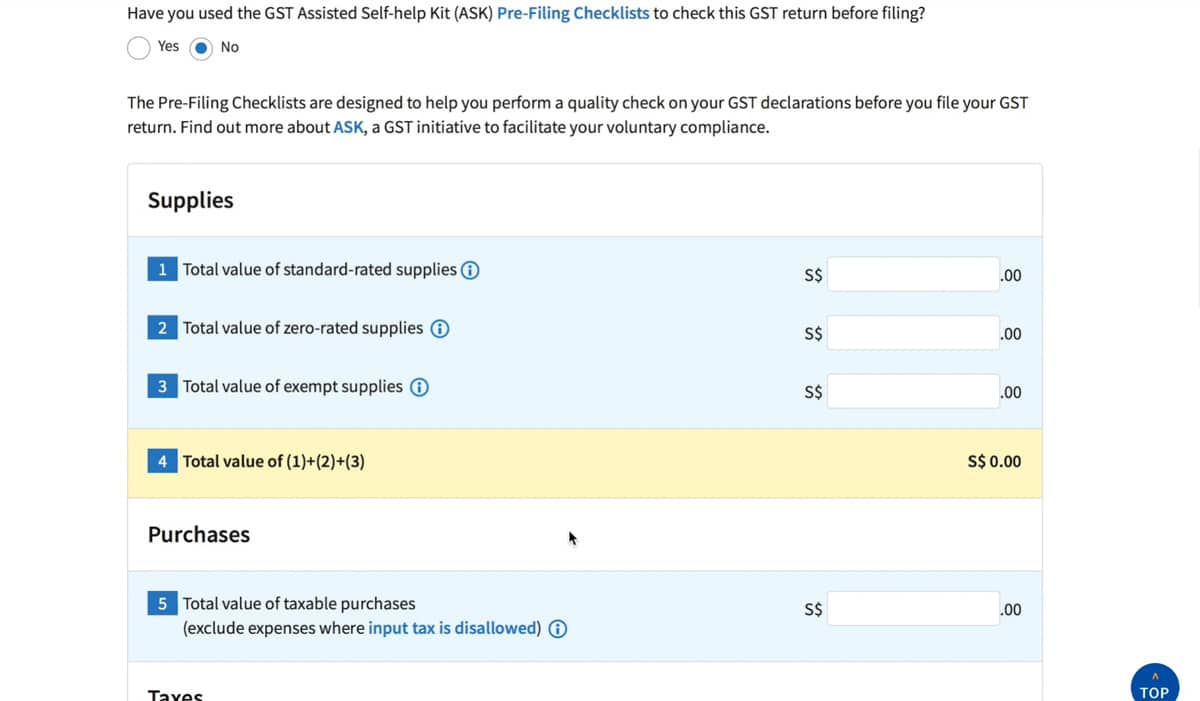

A Basic Guide To Gst F5 Form Submission To Iras Paul Wan Co

Gst Return Filing Online Learn How To File Gst Return

Obtaining New Access Code To Netfile Gst Hst Return Filing Taxes

Gstr 3a Notice For Not Filing Gst Return Indiafilings

2022 Tax Deadlines Canada When Are Corporate And Personal Taxes Due Blog Avalon Accounting

Calendar For Gst Return Filing

How To Pay Business Taxes In Canada

Gst Hst Reporting Period How Frequently Do I Need To File Djb Chartered Professional Accountantsdjb Chartered Professional Accountants

Gst Remittance Form Fill Online Printable Fillable Blank Pdffiller

How To Complete A Canadian Gst Return With Pictures Wikihow